Runview combines the strength of its proprietary technology with the skills of its specialist consultants to deliver real added value to its supplier over-payment audit clients. Data-mining, artificial intelligence and consultant expertise are the core components in its method. Identifying all the irregularities there might be in the accounting records while aiming for pinpoint accuracy in its findings are the order of the day.

About fifteen years ago, Runview took the decision to develop its own data mining software, called Exaus© to analyze its clients’ accounting data records. The benefit was the ability to build its own search algorithms combining increasing data processing capacity with Runview’s consultants’ business knowledge. Over time, the R&D team has enhanced this software by broadening the range of analyses it runs, increasing the speed, and expanding the volumes it can handle. These developments have brought about improved quality in the software’s findings, not only in detecting all irregularities, but also in eliminating false positives.

This work means that the findings of Runview audits hit the sweet spots of both completeness and accuracy. Take a look under the hood at what makes all this possible.

Detecting all irregularities

Runview is committed to finding all the supplier over-payments and overlooked input VAT irregularities that might exist in its clients’ accounting systems.

To achieve this, Exaus© searches all the accounting data held. To identify double payments, therefore, the algorithms are not only interested in the three key elements of an invoice, i.e. its number, the amount, and the supplier's name, but they also use all the fields that characterize any accounts entry, including the invoice, data entry and payment dates, item descriptions, accounting ledgers used, and so on.

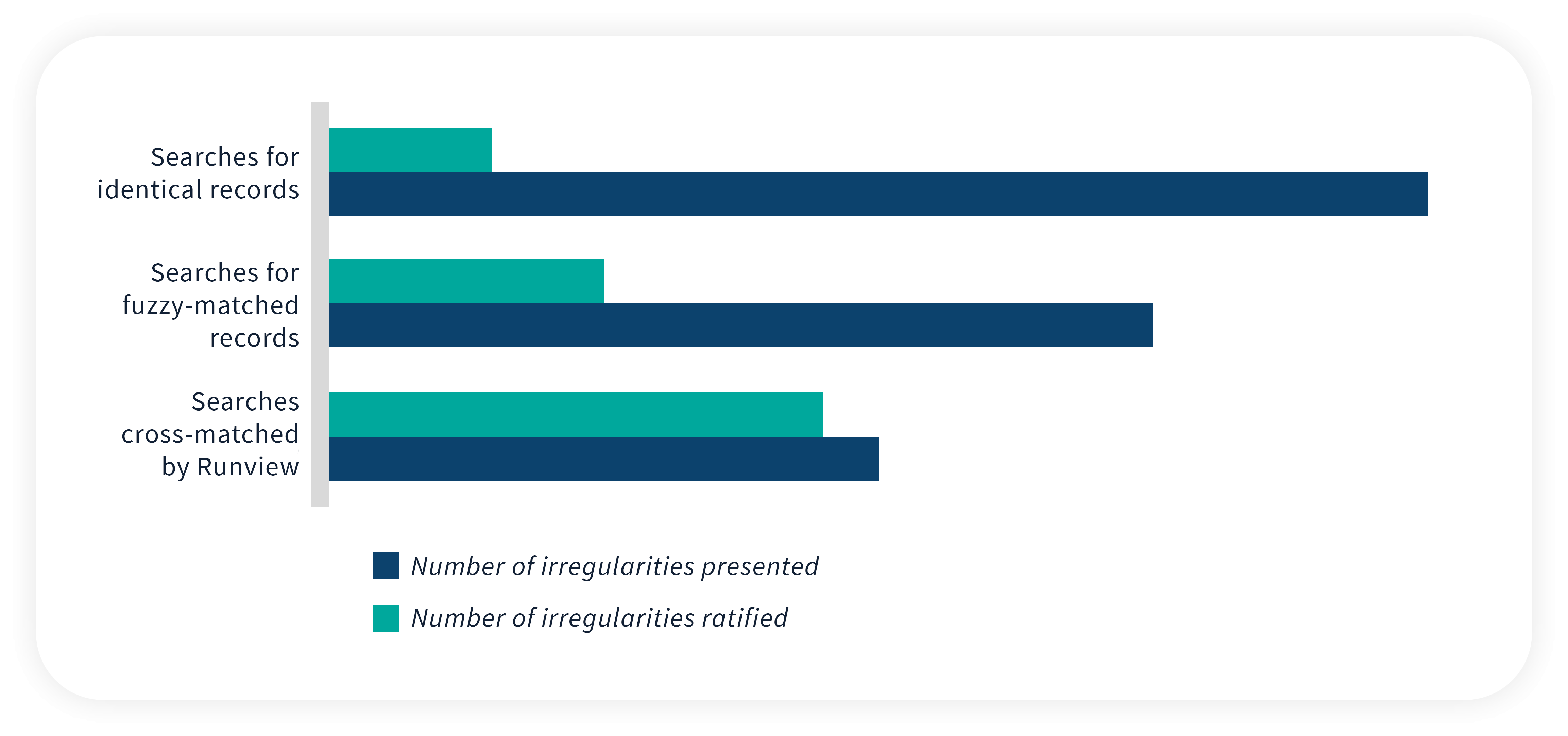

The completeness of our findings is boosted by using a number of search methods. Statistical search algorithms are used to find not only when two accounts entries are strictly identical, but also and crucially fuzzy similarities. In fact, ERP configuration often allows a company to prevent the same invoice being entered twice. At this point, 90% of the double payments found by Runview are the result of similar, but not identical, accounts entries. “There are some points we could have found ourselves, but others that are very difficult to detect because we do not have Runview’s tools or procedural method. It is important to also get this outside view from a third party auditor,” explains Anne Guironnet-Rougeon, manager of Arkema’s services center in France.

Artificial intelligence algorithms are also used, able to retrospectively determine the features characteristic of irregularities by examining data from Runview’s past experience. They can then find similar irregularities when examining new sets of accounting records. Alongside this method, known as machine learning, the experience of Runview’s consultants, who are all masters at spotting less obvious clues, is added into the mix.

The blend of these different methods delivers comprehensive results, bringing to light all the irregularities that might creep into your accounts payable records.

Sorting the wheat from the chaff

The findings are then filtered and “cleaned” with the aim of eliminating false positives.

The Exaus© data mining algorithms are able to detect mirror-image reversal entries intended to correct previous errors, so these are removed. This means clients are not presented with irregularities that they have in fact already noticed and fixed themselves.

They also hunt down any adjustment entries that might have been entered into the system. These are harder to characterize than mirror-image reversals, but they might include a reference to the invoice number, which Exaus© can easily find. Other, more complicated entries, require the expert eye of Runview’s specialists, which then becomes a crucial factor in detecting adjustments of this kind.

Regardless of the type of irregularity suspected, whether overlooked input VAT or supplier over-payments, our consultants always examine the corresponding invoice. This serves to eliminate false positives which otherwise might have slipped through the earlier stages in the process, and to document the established irregularities with supporting paperwork to make the ratification stage easier.

As proof of the effectiveness of this “cleaning” of the software’s suggestions, 89% of the VAT irregularities presented during Runview’s last 80 audits were ratified by the clients.

An effective audit mechanism that makes a difference

This method, a blend of exhaustive detection backed by a clean-up of the irregularities found, is the key factor behind the added value delivered by Runview’s audits.

Unlike analysis by sampling, with a single type of search or criteria that are too basic to be useful, a Runview audit provides the assurance that no error will be missed. The audit results in a maximum possible cash return and offers an assessment of where processes could be improved.

While Runview’s filtering of the software’s findings avoids the kitchen-sink approach offered by certain other audit firms, the software does have a role to play in making the exercise not at all time-consuming for the client. The audit’s findings are presented using a secure online client portal, where each irregularity is documented with a direct link to the relevant invoice and details of the accounts entries in question. Runview’s method consequently ensures the clients’ ratification time is both short and productive. “I was surprised to note the audit did not necessarily mean extra workload for in-house staff. The various stages actually took a relatively short time from start to finish, the dialogue between us and Runview was very efficient, and not at all time-consuming for us,” says Audrey Coullet, head of accounts payable at Novartis Pharma.

About the author

Managing Director - Produit

Diplômé de l’Ecole des Mines de Nantes, Franck rejoint en 2006 l’aventure Runview. Il définit la stratégie des produits de Runview et supervise avec le CTO les développements des logiciels et des algorithmes par l'équipe R&D.

All the author's articles