Audit your supplier over-payments

-

Solutions

Keep control over your accounting systems. Combining a unique data analysis technology with bespoke support and guidance from our expert consultants, Runview has set the standard in helping its clients safeguard their financial resources. Detecting and recovering supplier over-payments has been our core business for 20 years.

Enhance the quality of your accounting

by identifying supplier over-payments

The sources of supplier over-payments

Regardless of the level of checks put in place, the accounts of any business will inevitably contain irregularities, difficult to detect and jeopardising its financial resources. On average, one in 1,000 invoices is paid twice. Apart from double payments, other types of supplier over-payment exist, such as credit notes that are not logged, or that are entered as invoices, data entry mistakes on invoice amounts, and so on.

The types of fault are many and varied. Our experience has shown that the causes of these irregularities include:

- Changes to a business’ organisational structure or its IT system;

- Off-shoring of invoice processing;

- Shortcomings in the procure-to-pay process;

- Failings in paperless office systems (OCR, EDI, etc.).

Audits of supplier over-payments and statement reviews

We have been protecting our CAC40 and SBF 120 clients from such losses since 2002, identifying supplier over-payments and recovering the money lost.

Our method uses two procedures:

- Finding over-payments in your accounting records, by examining your accounts data;

- Finding unused credit notes in your accounting system, by conducting supplier statement reviews.

An end-to-end methodology

Our expertise is based on a combination of our proprietary technology, which incorporates data mining and artificial intelligence algorithms, and support and guidance from our highly experienced consultants. Every audit is tailored to best match the precise needs of the client’s business.

By examining the data integrity of the fields in accounts entries, our functional algorithms are able to locate each and every irregularity. The findings are then cleaned up to remove false positives, retaining only established irregularities that were previously undetected by the client.

The knowledge of the consultants assigned to the audit then comes into play, investigating each error found and cross-referencing each against the relevant financial documents.

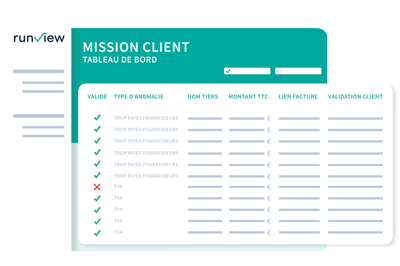

Once the irregularities detected have been ratified by the client using our Exaus® secure client portal, our specialised reimbursement team takes charge of recovering the corresponding amounts from the suppliers.

Our audits are designed to involve your staff as little as possible, from starting the assignment through to reporting the findings. Other than access to the accounts data and the relevant financial documents, our clients’ involvement is limited to ratifying the potential irregularities identified. In addition, our clients always retain control over any steps taken in relation to their suppliers. Our consultants are available at any point, to answer your questions and provide assistance if needed.

Reasons for conducting an audit

of supplier over-payments

Avoid any squandering of cash

Aggregated over a number of financial years, the cumulative effect of supplier over-payments can represent a substantial financial loss for your business, and can easily reach hundreds of thousands of euros. An audit of supplier over-payments protects you against such losses, and generates an immediate positive impact on your cash flow and net earnings.

Test business processes and improve their reliability

Over and above recovering cash owed to you, our audits also aim to test and consolidate the business processes in place. By limiting the recurrence of the irregularities found by our consultants, the audit delivers improvements to your in-house procedures. The recommendations we issue at the end of an audit are generally used by our clients to implement new measures, such as extra training for accounting staff on the identified points to watch.

Client references

A win-win audit

The way we are paid guarantees a positive return on investment. Payment takes the form of a success fee, based solely on a percentage of the money that is actually recovered. You can consequently start an audit without incurring any costs.

An audit takes 12 to 16 weeks altogether to complete, and 80% of the sums identified are recovered within 3 months.

An audit of supplier over-payments can be run at the same time as an audit of overlooked input VAT.